Seamless Steel Pipe Supplier from China

India takes action against Chinese steel, will the trade war heat up again?

On April 21, 2025, the Indian Ministry of Finance announced a temporary tariff of 12% on some imported steel products. The policy will take effect immediately and will be valid for 200 days, mainly targeting Chinese steel products. This incident has had many impacts on the global industrial chain:

Impact on the Sino-Indian steel industry

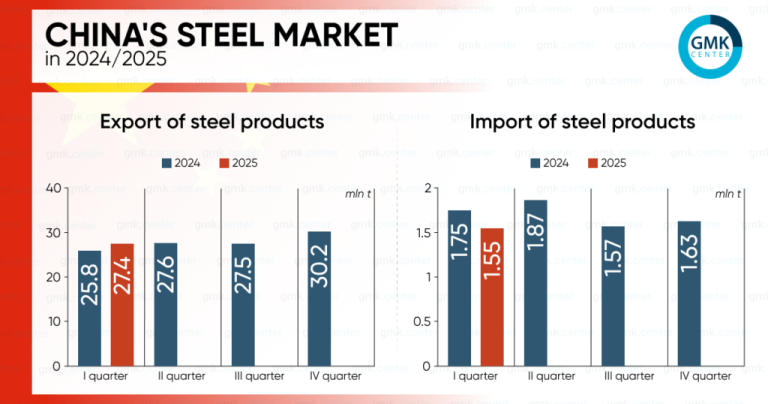

Chinese steel industry: China’s steel exports may face short-term pressure, but the Indian market accounts for less than 5% of China’s total exports, and the overall impact is limited. However, Chinese steel mills may adjust their market strategies and turn to the Southeast Asian market to compete with Japanese and Korean companies. In the long run, Chinese companies need to accelerate the transformation from “product export” to “technical cooperation”, take advantage of Indian steel mills’ demand for green steelmaking technology, and expand cooperation space.

Indian steel industry: Although the imposition of tariffs can provide a breathing space for Indian local steel companies, especially small and medium-sized steel companies, in the short term, and increase the market share of local giants such as Tata and JSW, in the long run, it may increase the dependence of inefficient production capacity on policy protection and delay the process of industrial upgrading. In addition, 70% of India’s steelmaking equipment and 40% of its special alloys rely on China for supply. Tariff barriers may cause its own industrial chain costs to soar, and even face the risk of rupture.

Impact on relevant downstream industries in China and India

Related downstream industries in China: As China’s steel exports may be affected, some downstream industries that rely on steel exports, such as steel structure manufacturing and machinery manufacturing, may face problems such as reduced orders and overcapacity. But at the same time, this may also prompt these industries to strengthen technological innovation, increase product added value, and expand domestic and other overseas markets.

Related downstream industries in India: India’s downstream industries such as auto parts and machinery manufacturing will face rising cost pressures, and the international competitiveness of small and medium-sized exporters may be damaged. Indian Railways warned that the budget for high-speed rail projects in 2025 may exceed 120 billion rupees. In addition, manufacturing and infrastructure projects are under pressure due to rising steel prices, inflationary pressures are intensifying, and economic growth prospects are overshadowed.

Impact on the global industrial chain

Supply chain pattern adjustment: India’s tariff measures may trigger adjustments to the global steel supply chain pattern. Chinese steel companies may increase their efforts to explore other markets, while Indian local steel companies, while receiving certain protection, also need to deal with the risk of unstable industrial chain. This may lead to changes in the flow of global steel trade. Some countries and regions that originally relied on Chinese steel may look for new sources of supply, while some countries and regions that originally imported steel from India may turn to other countries due to rising Indian steel prices.

Rising risk of trade protectionism: India’s imposition of tariffs this time may trigger a chain reaction. Traditional markets such as the EU and the United States may follow the “Indian model” and set up more “compliance barriers” for Chinese steel, thereby further exacerbating the global trade protectionism atmosphere and adversely affecting the stability and development of the global industrial chain.

The incident of India’s imposition of tariffs on Chinese steel not only reflects the trade game between China and India, but also highlights the fragility and complexity of the global industrial chain when facing the challenge of trade protectionism.